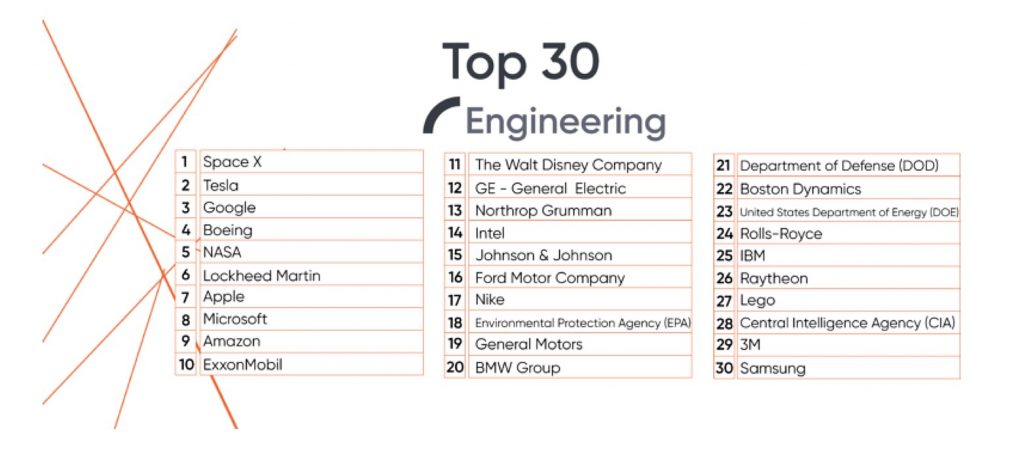

Employer branding specialist Universum has released its 2019 rankings for the most attractive employers in the United States. Based on the firm’s findings, which were tabulated from a survey of tens of thousands of students from hundreds of universities, it appears that two of Elon Musk’s companies, SpaceX and Tesla, are perceived by engineering students as the best employers in the country.

SpaceX, Elon Musk’s private space company, was dubbed by engineering students as the No. 1 employer they wish to work for, dethroning NASA, which topped last year’s rankings. Among the respondents of Universum’s survey, 20.7% of engineering students listed the disruptive space firm among their Top 5 ideal companies. SpaceX moved up significantly in this year’s rankings too, as the company was ranked No. 3 in the branding firm’s survey in 2018.

Tesla stood proudly at No. 2 in Universum’s rankings, with18.7% of engineering students listing the electric car maker as one of their Top 5 ideal employers. Tesla was also ranked 2nd in the branding firm’s 2018 surveys, which all but highlights the strength of the company’s brand. This is all the more impressive if one were to consider the noise from skeptics surrounding the company, which have largely dominated the news cycle around Tesla for the past months.

Both Tesla and SpaceX are known for being workplaces that are incredibly challenging. During the early days of SpaceX, the company’s recruiting pitch was simple: it was the “special forces” in the space industry. This pitch, which all but highlights the hard work and dedication required of all SpaceX employees, all but became a beacon that attracted the most dedicated workers. As history would show, being special forces has its merits, as SpaceX currently offers employees the opportunity to work for a company that quite literally is leading the private space race.

Tesla, for its part, is known to be just as challenging as SpaceX. While one could argue that electric car manufacturing is not as complicated as rocket science, the sheer scale of Tesla’s operations is enough to keep every employee busy. As noted by a study from Handshake, a student career-services app, last year, this intense work culture is actually among the reasons why applicants consider the electric car maker as an attractive place of employment.

One common denominator between SpaceX and Tesla that is likely compelling for job-seekers is CEO Elon Musk, whose style of leadership is equal parts daunting and inspiring. While Musk is known to be a leader who demands a lot from his employees, he is also a leader that prefers to stay in the front lines. During the challenging days of Tesla’s Model X and Model 3 production ramps, Musk slept in the company’s Fremont factory, just so he could address any issues in the facility as they arose. Anecdotes from the Tesla community during the construction of GA4 also indicate that Musk was among the workers torquing bolts in the new Model 3 assembly line.

This extends to Musk’s use of Tesla’s technologies as well. As indicated in a report from The Information that featured accounts from members of Tesla’s Autopilot team, Musk uses himself as a test subject for the company’s driver-assist software. Musk’s personal vehicle is loaded with pre-released “development build” Autopilot versions, which allow him to push the driver-assist software to its limits. This practice has allowed Tesla to quickly spot Autopilot’s areas for improvement, though according to the publication’s sources, it has also resulted in Musk finding himself in “situations that many of us wouldn’t want to be in.”

<!–

–>